Excitement About Home Owners Insurance In Toccoa Ga

Right here are five actions to assist you pick a monetary consultant for you. Handling your riches is hard. Zoe Financial makes it very easy. Locate and employ fiduciaries, economic consultants, and economic coordinators that will certainly collaborate with you to attain your riches objectives. Paid non-client promotion, Geek, Wallet doesn't spend its money with this carrier, however they are our reference partner so we obtain paid only if you click with and take a certifying action (such as open an account with or supply your contact info to the carrier).

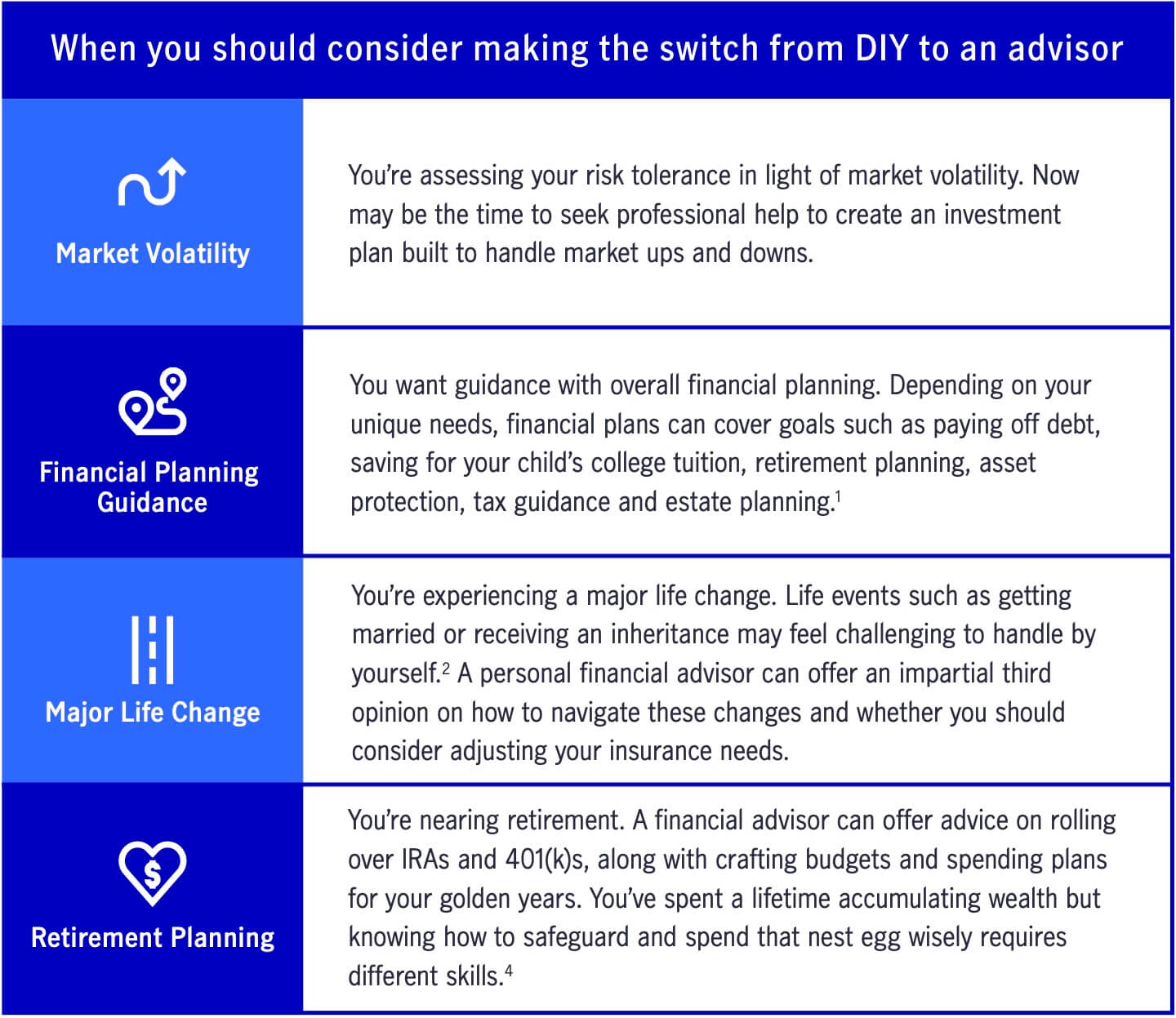

Prior to you begin looking for the right advisor, mirror on what you're wishing to obtain out of that connection - Commercial Insurance in Toccoa, GA. Financial experts supply a large variety of services, so it's an excellent idea to know what you require assistance with before you start your search.

How Life Insurance In Toccoa Ga can Save You Time, Stress, and Money.

Identify why you're looking for financial aid by asking the adhering to inquiries: Do you need assist with a budget plan? Would you such as to produce a monetary plan? Your answers to these questions will help you find the appropriate kind of monetary advisor for you.

, or CFP, classification have a fiduciary duty to their customers as component of their accreditation (https://www.anyflip.com/homepage/oufpj).

Nerd out on investing information, Subscribe to our month-to-month investing e-newsletter for our nerdy take on the stock exchange. Financial consultants have a credibility for being pricey, however there is a choice for every spending plan. It's vital to comprehend just how much a monetary consultant costs prior to you commit to solutions.

Excitement About Automobile Insurance In Toccoa Ga

Just how much you need to invest in a monetary advisor relies on your budget plan, assets and the degree of monetary guidance you need. If you have a small profile, an in-person advisor could be overkill you will certainly save cash and get the support you require from a robo-advisor. If you have a difficult monetary situation, a robo-advisor might not provide what you require.

25% of your account balance per year, standard in-person experts usually set you back around 1% and online financial preparation solutions often tend to drop somewhere in between. Who can be a monetary advisor?

Anybody that offers investment guidance which most economic experts do must be registered as an investment expert with the SEC or the state if they have a certain amount of possessions under monitoring. Why is "expert" sometimes spelled "advisor"? Exists a distinction? While the 2 terms are frequently utilized reciprocally, "advisor" is the legal term utilized in the U.S

The Ultimate Guide To Affordable Care Act Aca In Toccoa Ga

Some organizations like the Structure for Financial Planning use free aid to people in requirement, consisting of veterans and cancer cells patients. And while you shouldn't think everything you keep reading the net, there are loads of respectable resources for financial info online, consisting of government sources like Capitalist. gov and the Financial Industry Regulatory Authority - https://www.nulled.to/user/5926895-jstinsurance1.

If you are attempting to pick a monetary consultant, recognize that any person can lawfully utilize that term. Always request for (and validate) a consultant's specific qualifications. Anybody that gives which most economic consultants do should be registered as an investment advisor with the SEC or the state if they have a specific quantity of properties under monitoring.

Vanguard ETF Shares are not redeemable straight with the issuing fund other than in huge gatherings worth numerous bucks. ETFs are subject to market volatility. When getting or offering an ETF, you will certainly pay or get the existing market value, which might be essentially than net possession worth.

The Greatest Guide To Home Owners Insurance In Toccoa Ga

A lot of monetary advisors function routine full-time hours throughout the job pop over to this site week. Many experts are utilized by firms, yet about 19% of financial experts are independent, according to data from the Bureau of Labor Stats. In regards to credentials, monetary advisors usually have at the very least a bachelor's degree in a relevant topic like company, money or math.

However, there are some crucial differences in between a financial expert and an accountant that you must know. Accountants are more concentrated on tax planning and prep work, while economic advisors take a holistic consider a customer's economic situation and help them prepare for lasting economic goals such as retirement - Health Insurance in Toccoa, GA. In various other words, accountants deal with the past and present of a client's financial resources, and monetary experts are concentrated on the client's financial future

Some Known Factual Statements About Commercial Insurance In Toccoa Ga

Accountants have a tendency to be hired on a short-term basis and can be assumed of as specialists, whereas financial consultants are most likely to establish a lasting expert connection with their customers. Accounting professionals and financial experts differ in their strategy to monetary topics. Accounting professionals tend to focus on a particular location, while economic consultants are often generalists when it pertains to their financial expertise.